Higher Interest Rates May be the Help You Need

Published | Posted by Parbatie Galvan

Lowering interest rates is like opening a faucet and increasing water flow – it stimulates home sales. Conversely, raising interest rates is like closing a faucet and decreasing water flow – it reduces home sales.

In a limited inventory scenario, when home sales increase, demand rises and prices follow suit. Similarly, when home sales decrease, demand can lessen, and prices can stabilize.

However, higher interest rates create an opportunity as they affect sales and demand, which, in turn, keeps prices in check. Waiting for rates to decrease might not be the best strategy as it could increase demand, which will further deplete the already low supply and cause prices to rise.

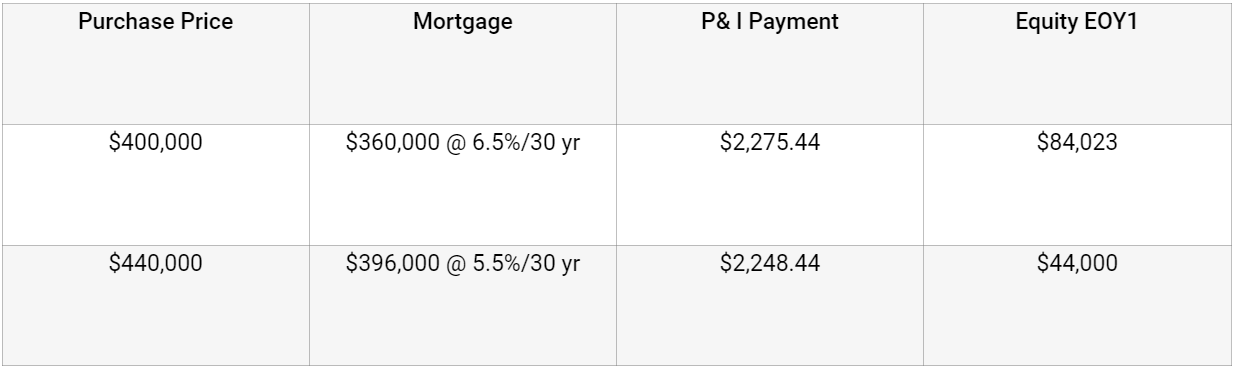

Let’s consider an example where you buy a home today for $400,000 with a 90% loan at 6.5% for 30 years with P&I payments of $2,275.44. If interest rates drop to 5.5% in a year, but the price goes up by 10%, the price would be $440,000 with a 90% loan at 5.5% for 30 years with P&I payments of $2,248.44.

In this scenario, the payment would go down by $27 a month, but the price would have increased by $40,000, which is twice the down payment for the person who purchased a year earlier with a higher rate.

The lesson to learn from this example is that during periods of high appreciation, a person might experience a greater loss from unrealized equity than waiting for a slight decrease in interest rates. With rates serving as a hindrance to buyers, resulting in a 22% year-over-year decline in sales as of March 2023, sellers might be open to negotiating.

It may appear contradictory, but higher interest rates could be the solution you require to purchase a home.

Related Articles

Keep reading other bits of knowledge from our team.

Request Info

Have a question about this article or want to learn more?